AI drives salary growth for experts while Juniors pay remains stagnant

Table of contents

One of the factors driving changes in the finance and accounting sector is artificial intelligence, which has contributed to a decrease in salaries at the entry-level positions. In contrast with specialized and expert roles, salaries have shown a significant increase.

Valued analytical skills and strategic thinking

Salaries in the finance and accounting sector continue to grow, despite a downturn in 2021. The most substantial increases are observed at higher-level positions. This growth is driven by the dynamic development of the market and the decentralization of many processes, which has led to an increase in responsibility and decision-making power for managers. Employers are increasingly valuing analytical skills and strategic thinking in a business context, resulting in higher salaries.

The salary growth primarily affects specialists and experts who influence decision-making processes. A similar trend is observed at higher managerial positions, such as Chief Financial Officer or Chief Accountant. At this level, not only has the base salary changed, but there is also a shift in the approach to bonuses—variable compensation has become a more significant part of the total remuneration, especially in the last two years, as noted by Michał Borkowski, Sector Manager, Antal Finance & HR.

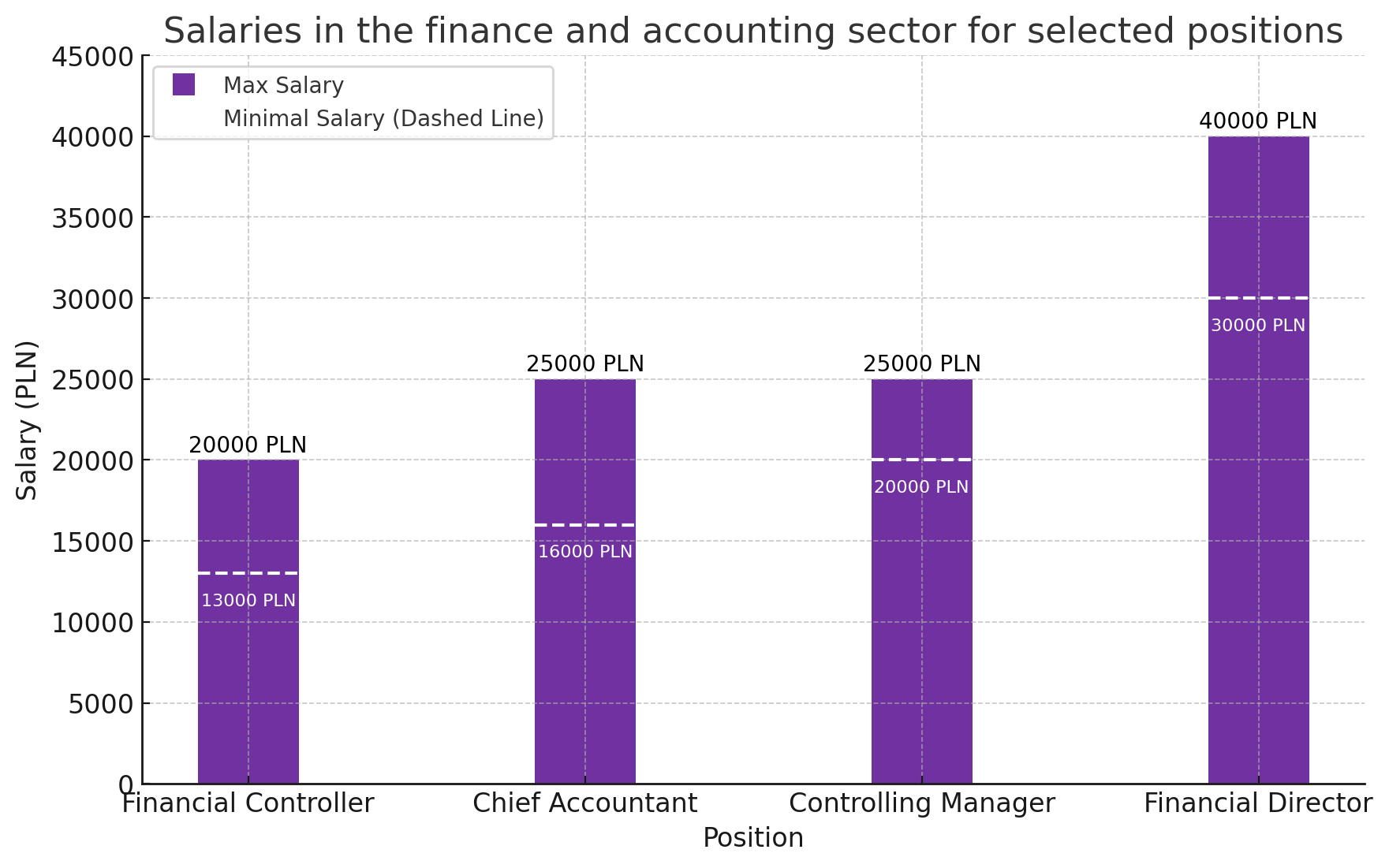

Top-paid specialists in finance and accounting

The highest salaries in the finance and accounting sector are earned by specialists in positions such as Chief Financial Officer (PLN 30,000 – 40,000 gross per month) and Chief Accountant (PLN 16,000 – 25,000 gross per month). The increasing demand for specialists in risk and internal audit, as well as controlling, also drives up salaries in these areas. Significant pay raises are also seen in substantive accounting positions—especially where there is contact with taxes and consolidated reporting. Practical knowledge related to the implementation of ERP systems is also highly valued.

The opposite trend in wage changes can be observed at junior positions. Artificial intelligence, which increasingly takes over simple analyses and tasks, is a factor hampering wage growth at this level of professional experience. As a result, the demand for employees performing routine tasks decreases, limiting wage growth opportunities. Employers are investing in technologies that automate basic processes, reducing operational costs. Thus, juniors need to develop more advanced skills to remain competitive in the job market - explains Michał Borkowski, Sector Manager, Antal Finance & HR.

The growing importance of controlling, risk, and internal audit

The finance and accounting sector is undergoing dynamic changes that shape salaries and demand for specialists. The increased role of controlling in organizations is a response to the need for effective cost management while maintaining high quality and increasing the profitability of the enterprise.

In Lower Silesia, particularly in manufacturing companies and logistics, candidate expectations in controlling have risen by 10-15% compared to the previous two years. For companies that have not conducted processes during this time, it is a significant expense, not only due to aligning budgets with the expectations of new employees but also to balancing salary levels for the rest of the team, who have so far only received small inflationary increases - comments Agnieszka Winiarz, Consultant Antal, Finance & Accountancy.

There is also a noticeable increase in recruitment in the areas of risk and internal audit. Global political uncertainty, armed conflicts, trade tensions, and economic instability contribute to the growing importance of these functions in organizations, which are intensifying their efforts in risk identification, assessment, and management. As a result, individuals with experience in financial, strategic, and market risk analysis are in demand. Simultaneously, the role of internal audit is growing, becoming a key tool in ensuring compliance with regulations and verifying the effectiveness of risk management systems.

Particular emphasis is placed on the ability to quickly respond to changing conditions and anticipate potential threats. Organizations strive to increase the transparency and credibility of their operations, which requires strengthening the audit function - notes Agnieszka Winiarz, Consultant Antal, Finance & Accountancy.

_______________

About the Antal Salary Report

The "Antal Salary Report" for 2024 was prepared based on an analysis of the salaries of 4,952 specialists and managers participating in Antal's recruitment processes during the second half of 2023 and the first half of 2024. These data were verified and supplemented with information from recruitment processes conducted by Antal consultants in 2023, as well as telephone interviews with employers and candidates.

Download the report: Antal Salary Report 2024

About Antal

Antal is a leading company in the CEE region, providing solutions in permanent recruitment, HR consulting, and outsourcing. The foundation of our success lies in the high quality of services offered and the people whose knowledge is the capital gathered during the company's 26 years of operation. We create methods and tools that exceed customer expectations and market standards, while also being a leader in sustainable transformation (ESG) in the industry. Antal's support is very broad—from the implementation of comprehensive permanent recruitment processes, through outsourcing services, including RPO and contracting, to Employer Branding activities, HR Consulting, and comprehensive market research and analysis services.