Warsaw's investment potential is growing. What will the capital's future look like?

Table of contents

The results of the latest Business Environment Assesment Study (BEAS) indicate that the readiness for new investment among companies in the nine surveyed cities averaged 92% in 2023. This is 1 percentage point higher than in the previous edition in 2021. 73% of the decision-makers of the surveyed companies say they will create new jobs because of this.

Another, fourth edition of the Business Environment Assesment Study (BEAS) report, whose authors are Antal and Cushman & Wakefield, and whose partners are Baker McKenzie, PAIH, Pracodawcy RP, Pro Progressio and Vastint, reveals the investment plans of the heads of companies operating in Polish cities for the years 2023-2025. Poland has long maintained and strengthened its leading position in attracting investments, including foreign ones. Warsaw, on the other hand, is at the forefront of these investments - the city has been recognised four times in the fDI 2023 ranking assessing European cities in terms of foreign direct investment.

Data from the real estate market clearly proves that Warsaw maintains an unthreatened leadership position in terms of investment potential, successfully competing with the other cities included in the study. The analysis not only sheds light on the current condition of the real estate market in the capital, but also indicates some grounds for optimism in the long-term perspective, comments Radosław Kostka, Acquisition Manager, Vastint Poland.

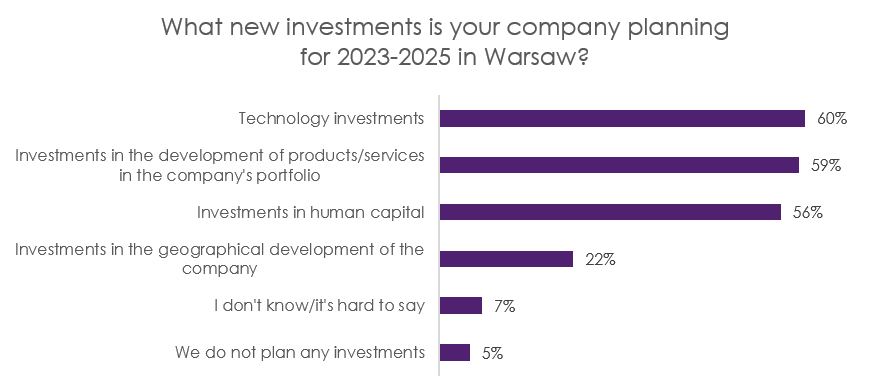

The level of planned investments goes up

A highly qualified workforce, a leading academic centre and a wide range of office properties are all factors that contribute to Warsaw being a thriving city and a leader in investment in Central and Eastern Europe. Warsaw was indicated as a place considered for investment for 2023-2025 by 29% of respondents. This is 6 percentage points higher than in 2021.

The capital has a huge investment potential, which survey respondents rated at 7.7 on a 10-point scale. This is 0.5 points higher than in the previous edition of the 2021 report. One of the magnets for investors is the large availability of highly educated specialists. Warsaw offers them the possibility of fast professional development and a high quality of life,' comments Karolina Zdrodowska, Director of the Coordinator for Entrepreneurship and Social Dialogue at the Warsaw City Hall, city partner of BEAS.

Warsaw employers will hire - but whom?

As a key business centre in Central and Eastern Europe, Warsaw is held in high regard by business representatives, as evidenced by a rating of 7.4/10 for the city's potential to employ professionals and managers. As many as 75% of respondents believe that employment levels in their company will increase. The most common increase will be between 6% and 15% - 36% of respondents say so. Only 9% of respondents are convinced that the percentage of total employment levels will decrease.

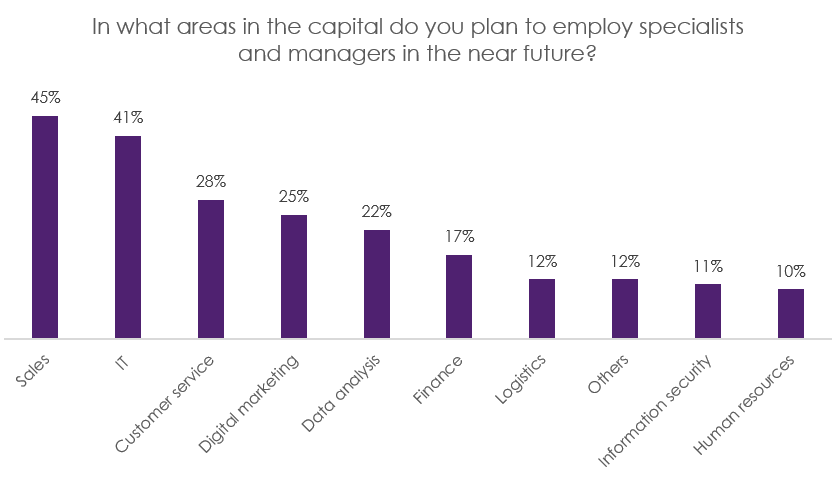

Warsaw is definitely a place where the potential for staff employment is one of the highest in this part of Europe. When asked in which areas employers in Warsaw plan to hire, the sales and IT departments come out on top. In sales, the most sought-after specialists at the moment are e-commerce specialists and digital marketing specialists. This type of competence is in demand all the time, and candidates have several offers on the table. On the other hand, in the IT sector, we can observe an ever-increasing demand for programmers with knowledge of Java and .NET, DevOps, Cyber Security specialists, as well as Cloud Security Engineers, comments Artur Skiba, CEO of Antal.

Developer activity on the capital's office market is falling significantly

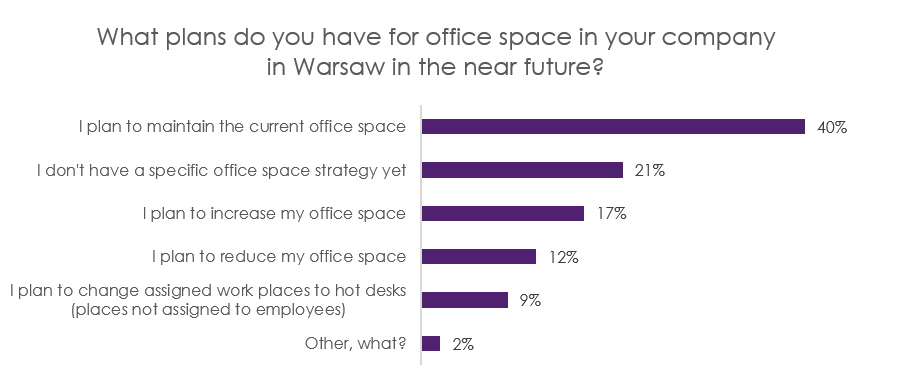

In Warsaw, which accounts for half of Poland's office stock, we are seeing a markedly reduced activity from developers. The lower volume of space under construction is, among other things, a result of the pandemic, which has significantly altered our way of working and, as a result, office occupancy levels, as well as the current economic situation with high financing and construction costs. So how do occupiers' plans look in the face of these challenges? The report shows that 40% of companies intend to keep the size of their offices unchanged, 21% of those surveyed do not yet have a specific strategy for the property they occupy, 17% would like to add additional space and only 12% are considering downsizing their office.

In 2023, only 66,000 sq m of new space will be delivered to the Warsaw market, which means that development activity will reach its lowest level in 25 years. Moreover, Warsaw has already entered a period of the so-called supply gap, which may last even until 2026. On the other hand, the activity of tenants expressed in the number of transactions concluded is successively increasing, as a result of which the vacancy rate is maintaining a downward trend. The recovery in demand is certainly being reinforced by a more rationalised approach to remote working. A very good prognosis for the Warsaw office sector is also the ambitious investment and recruitment plans indicated by respondents to the Antal and Cushman & Wakefield survey, which in time should also encourage developers to start new investments in the Warsaw market - summarises Krzysztof Misiak, Head of Cushman & Wakefield Poland.

____________________________

ABOUT BEAS

The Business Environment Assesment Study was conducted using the CAWI method among 1,290 business decision-makers in Poland between 31.07-25.08.2023. The reports produced as part of this and the previous edition of the project are available on a new interactive portal enabling comparison of key indicators for cities and downloading selected summaries https://investmentpotential.pl/en/