Financial controller: salary and responsibilities

Table of contents

A financial controller is a key figure in any organization. They are responsible, among other things, for monitoring and managing the financial aspects of the company. This profession is extremely future-oriented, while also providing good salaries. So, what do you need to do to be employed in this position? How much does a financial controller earn? Let's find out!

What does a financial controller do?

A financial controller is a specialist whose main task is to ensure that the financial activities of the company comply with applicable legal regulations, ethical standards, and best business practices. Therefore, they are a key participant in the process of planning, monitoring, and reporting the organization's financial activities. What are their specific duties?

- Monitoring and analysis of financial data – the financial controller is responsible for collecting, analyzing, and interpreting the company's financial data to ensure their accuracy and to identify financial trends and risks.

- Preparation of financial reports – the person employed in this position prepares regular financial reports, including balance sheets, income statements, and cost analyses, which are essential for strategic management.

- Budget management – the financial controller also assists in the development and management of the company's budget, monitoring its implementation and identifying any deviations, and proposing appropriate corrective actions.

- Support in making business decisions – the financial controller supports the company's management in making strategic business decisions by providing financial analysis and forecasting results.

The detailed scope of duties varies depending on the position held, however, as the name of this profession suggests, the financial controller is largely responsible for the finances of the organization in which they are employed.

Who can become a financial controller? Requirements

Candidates for the position of financial controller typically have at least a bachelor's degree in finance, accounting, economics, or related fields. Most employers prefer candidates with a master's degree in these fields or equivalent professional experience. Skills also matter. What counts as skills?

- Knowledge of accounting – a financial controller must have knowledge of accounting and the ability to analyze and interpret financial data.

- Financial management – the ability to manage budgets, analyze costs, and forecast finances are crucial for performing the duties of a financial controller.

- Proficient use of financial software – a financial controller should be adept at using various financial tools and software, such as ERP (Enterprise Resource Planning) systems or programs for financial data analysis.

- Analytical skills – advanced analytical skills are crucial in this position to perform complex financial data analysis and draw conclusions based on them.

Where are financial controllers employed?

Where can a financial controller find employment? As it turns out, the choices are quite extensive. The industries in which financial controllers work encompass a wide range of sectors of the economy. These can include financial and banking sectors, where monitoring financial risk and efficient capital management are crucial for company success. Conversely, in the manufacturing industry, financial controllers assist in optimizing production processes and costs, while in the trade and distribution sector, they engage in sales analysis and inventory management.

Financial controllers are also present in the technology and IT sector, where they assist in analyzing technological investments and achieving financial goals related to the development of new products or services. In professional services, such as consulting or advisory services, financial controllers support companies in financial management and strategic business decision-making.

They also play a significant role in the education sector, where their task is budget management and ensuring adequate funding for educational institutions. Furthermore, financial controllers work in both the private and public sectors. Their goal may be to maximize profits and operational efficiency in business activities or to ensure transparency and effective management of public funds.

Financial Controller – Salaries

The salaries of financial controllers depend on many factors, both related to the controller themselves and their employer. The following are especially important:

- Professional experience – financial controllers with more experience usually receive higher salaries;

- Level of education – individuals with higher education, such as a master's or bachelor's degree in finance, accounting, or economics, can expect higher salaries;

- Company size and industry – the salaries of financial controllers can vary depending on the size of the company, its industry, and geographical location. Typically, larger companies offer higher salaries, reflecting the complexity of their financial operations.

- Skills and competencies: Financial controllers with specialized skills, such as proficiency in advanced analytical tools or experience in financial risk management, can expect attractive financial terms.

But what does attractive financial terms mean? What are the salaries of financial controllers?

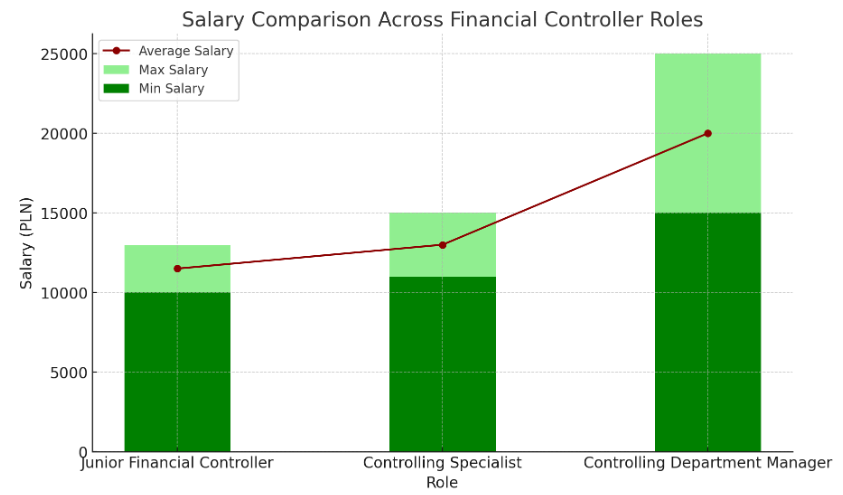

Salary data comes from the Antal Salary Report

According to a salary report prepared by experts from Antal, a financial controller can expect salaries ranging from 12,000 to 20,000 Polish złoty gross per month. These are high amounts, significantly exceeding the Polish national average.

How much does a junior financial controller earn?

A junior financial controller, i.e., a person at the early stage of their career in this position, can expect lower salaries compared to their more experienced colleagues. However, they are still relatively attractive.

According to the Antal salary report, a junior financial controller can expect salaries ranging from 6,000 to 10,000 Polish złoty gross per month. However, much depends on their skills. An important advantage is the open path to advancement.

Financial controller is a profession that is gaining importance in many industries. Individuals with analytical skills and an economic education can have plenty of job opportunities and shouldn't complain about their salaries. Therefore, considering this career path is worthwhile.