Warsaw is the capital of fintech: prospects and forecasts for investors and careerists

Table of contents

The number of fintechs in Poland increased by 82% in 2023 compared to 2022. However, 45% of fintech companies are based in Warsaw. The percentage of fintechs in Warsaw increased by 6 percentage points year on year. Thanks to its innovation ecosystem and support for start-ups, the capital attracts talent and investments, creating the future of financial technologies.

The latest report "The fintech industry in Warsaw" prepared by Antal for the Capital City Office. Warsaw sheds light on how investors perceive the capital and the future of the fintech sector in the region. Warsaw, already recognized as one of the leading innovation centers in Central and Eastern Europe, attracts the attention of investors thanks to the dynamic development of financial technologies.

Warsaw is a leader in cashless payments

Warsaw is dynamically becoming the fintech capital of the CEE region, concentrating almost 50% of Polish fintech companies in its area. Their number in Poland increased from 167 in 2018 to 417 in 2023, a significant part of which is located in the capital. This expansion indicates Warsaw's growing influence in the global fintech sector, especially in areas such as cashless payments and the development of blockchain technology.

The development of the fintech sector in Warsaw confirms our vision of transforming the capital into an innovation hub that attracts both investments and talents. Our commitment to creating a friendly environment for this type of companies is one of the key elements of the city's development strategy. That is why so many innovative companies from the fintech sector have decided to operate in Warsaw. This proves our leading position in the field of financial technologies in the region, says the mayor of Warsaw, Rafał Trzaskowski.

Warsaw ranks 2nd among the most cashless Polish cities according to the Cashless Cities ranking. Polish payment solutions, such as BLIK, are unique on the continent, but also in the world. According to the Global Index of Financial Centers, the capital ranks 70th globally, but 3rd in the Eastern Europe and Central Asia region.

The dynamic, almost doubling, increase in the number of fintech companies in Poland from 2018 to 2023 has led to a situation where there are over 20,000 available candidates in the fintech industry in Warsaw. These candidates are people who have worked or currently work in fintech companies, which proves the dynamic growth of the sector and its role as a key employer in the capital. At Antal, we follow this development to provide the best career opportunities for talents and support for fintech companies in their development, which is reflected in the report 'Fintech industry in Warsaw' - adds Artur Skiba, President of the Management Board of Antal.

Specialists are drawn to Warsaw fintechs

Warsaw, as the heart of Polish fintech, attracts the most innovative talents and companies. Fintechs are a very tempting place to work for thousands of employees of mature financial institutions due to the high attractiveness of the start-up environment, few formalities and regulations, as well as greater decision-making of employees at lower levels. Warsaw attracts foreign specialists from the financial sector primarily due to the presence of foreign companies such as Point75, Goldman Sachs and JP Morgan, involved in international projects.

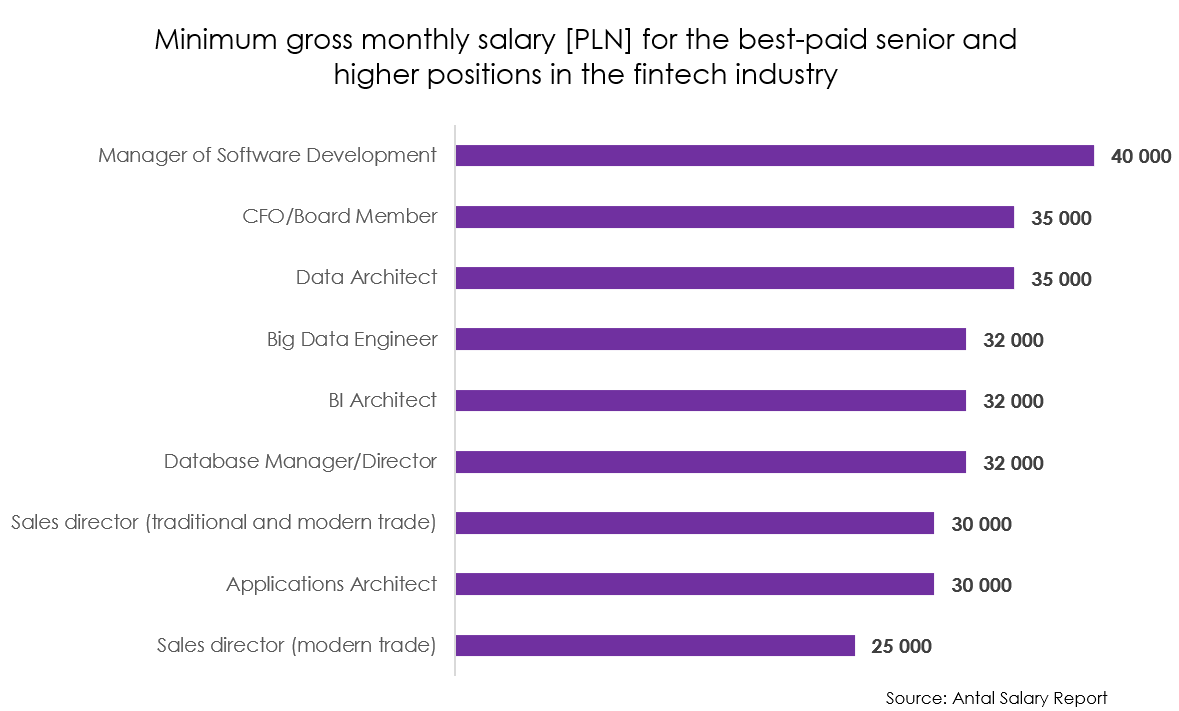

As a recruitment company, we are observing a significant increase in interest in positions in the fintech sector, which is proof that the city is now one of the most important European hubs. Employers in the fintech industry are looking for people who have both hard skills and soft skills. The demanding financial sector needs specialists with knowledge of new technologies and analytical skills that are necessary to effectively solve problems. However, soft skills are equally important, such as emotional intelligence and strong communication skills, which allow for effective cooperation with the team and building lasting relationships with clients. At the beginning of their career, experts in this industry can count on a salary of PLN 8,000-12,000. PLN gross, while specialists with over 5 years of experience earn on average PLN 20-30 thousand. PLN gross per month – comments Sebastian Sala, Business Unit Director Antal, Banking & Insurance, SSC/BPO.

New horizons of financial technologies

Recent years have seen significant growth in the insurtech and crowdfunding sectors, recording growth of 175% and 89% respectively in 2022. The global index of financial centers also places Warsaw in 3rd place in the Eastern Europe and Central Asia region, which proves the city's growing strength and influence in the fintech industry.

Despite dynamic development, there is still potential for further integration of fintech solutions with traditional financial services. More advanced technologies, such as artificial intelligence or blockchain, can contribute to the creation of more effective, innovative financial products. An example is Nomad Fulcrum - a tokenized, fully regulated hedge fund operating on the basis of advanced artificial intelligence solutions, which shows that Warsaw also attracts deep-tech companies. This proves the possibilities that are still waiting to be discovered in the fintech industry - comments Paweł Łaskarzewski, CEO, Nomad Fulcrum.

ABOUT THE STUDY

The study was carried out using a qualitative analysis of 10 standardized interviews with representatives of companies from the fintech sector (department directors and C-lvl from the financial/fintech industry running business in Warsaw or outside) and desk research. The study was supplemented with 20 expert comments from people associated with the fintech sector.

Download here: https://en.antal.pl/insights/report/fintech-industry-in-warsaw?_gl=1*mywbqu*_gcl_au*MTU4NTMzOTM3NS4xNzA1NTc5NDUx