Tax Advisor - Salaries and Responsibilities

Table of contents

A tax advisor is a profession that is becoming increasingly popular due to the ever more complex tax regulations and the growing demand for professional support in this area. In the following article, we discuss the potential earnings of a tax advisor, what their exact responsibilities are, and the steps to take to start a career in this profession.

How Much Does a Tax Advisor Earn?

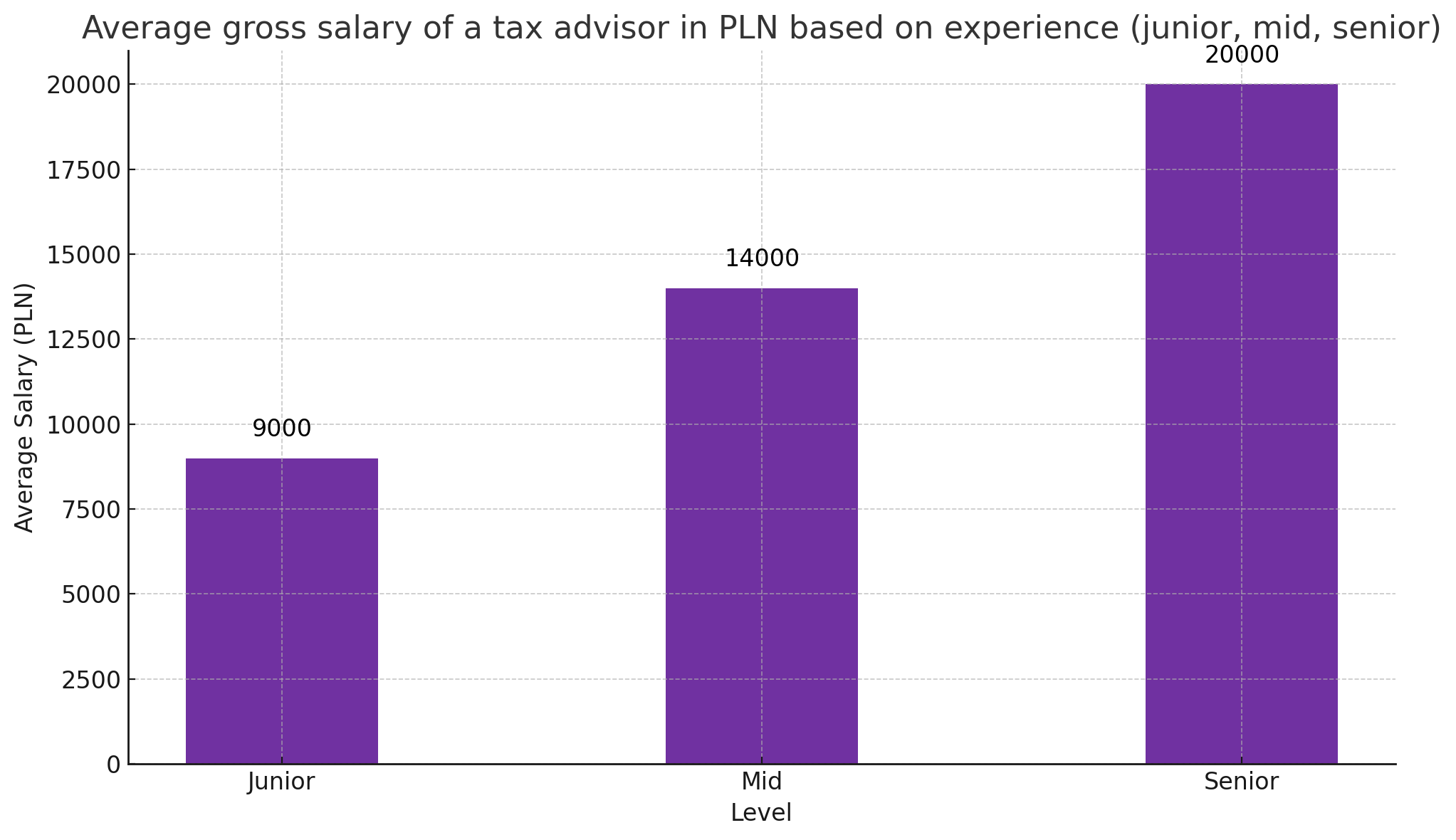

The earnings of a tax advisor can vary significantly depending on experience, specialization, and the region in which they work. According to the latest Antal Salary Report 2024, the median salary of tax advisors in Poland is approximately 14,000 PLN gross per month. Young advisors who are just starting their careers can expect to earn between 8,000 and 10,000 PLN gross per month. In contrast, experienced specialists with many years of practice and a broad client portfolio can earn around 20,000 PLN gross per month, and in some cases, even more.

Below is a chart illustrating the average salary of a tax advisor based on the level of experience.

The Antal report also indicates that tax advisors employed in large international consulting firms can expect higher salaries compared to those working in smaller, local firms or running their own businesses. Additionally, tax advisors specializing in narrow fields such as international tax law or tax optimization often earn more than their colleagues providing general advisory services.

What Does a Tax Advisor Do?

A tax advisor is a specialist whose main task is to help clients understand and apply tax regulations. In practice, the duties of a tax advisor include a wide range of services, such as:

- Tax Advisory: Providing advice on the interpretation and application of tax regulations, tax planning, and optimizing tax liabilities.

- Preparing Tax Returns: Preparing and submitting annual tax returns for both individuals and legal entities.

- Representation Before Tax Authorities: Representing clients before tax offices and other institutions in matters related to tax liabilities, including control and judicial proceedings.

- Tax Analysis and Audit: Conducting tax audits to identify potential irregularities and tax risks and preparing corrective recommendations.

- Training and Education: Conducting training and workshops for clients on current tax regulations and their changes.

Tax advisors work with various groups of clients, from individuals, through small and medium-sized enterprises, to international corporations. Their work requires not only in-depth knowledge of tax law but also analytical thinking skills, precision, and communication abilities.

How to Become a Tax Advisor?

To become a tax advisor, several key requirements must be met. First and foremost, it is necessary to obtain the appropriate education and professional qualifications. Below are the steps to take to start a career in this profession:

Higher Education: The first step is to complete higher education, preferably in fields related to economics, law, finance, or accounting. Although this is not an absolute requirement, having a degree in one of these areas greatly facilitates gaining the knowledge needed for the job.

Tax Advisor Application: After completing higher education, one must undertake a tax advisor application, which includes theoretical and practical preparation for the profession. The application ends with a state exam, which must be passed to obtain tax advisor qualifications.

Obtaining Qualifications: After passing the exam and receiving a positive opinion from the Examination Board, the candidate is entered into the list of tax advisors maintained by the National Council of Tax Advisors. From that moment, they can legally provide tax advisory services.

Continuous Improvement: Tax regulations are dynamic and often change, so tax advisors must constantly update their knowledge by participating in training, courses, and keeping up with current legislative changes.

Professional Practice: Gaining professional experience, for example, by working in a consulting firm or running one's own business, is crucial for the development of a tax advisor's career. It is also worth considering specializing in a specific tax field, which can increase market attractiveness and salary levels.

A tax advisor is a demanding profession but also offers extensive opportunities for professional development and satisfying remuneration. Through continuous improvement and acquiring new skills, tax advisors can count on stable and well-paid work in a dynamically changing business environment.