These specialists in banking and insurance are the most lacking. For whom is 2022 a year of increases?

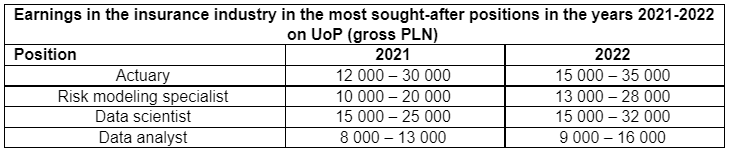

According to the 11th edition of the Antal Salary Report, the average monthly salary in banking and insurance amounted to PLN 12,724 gross, which means an increase by 7% compared to the previous edition of the report. This is one of the most moderate changes in the described market areas. However, what characterizes this market are primarily large differences in the situation of individual groups of positions.

2021 in insurance was marked by stable development, as well as a noticeable focus on digitization and process automation. In the fight for high-class specialists, insurance companies no longer face only their sister banking industry, but more and more often, insurance experts are used by fin-techs or the consulting industry. In addition, the constantly emerging challenges related to the implementation of new legal regulations cause an increasing demand for new employees. What does it look like now and what industry specialists are worth their weight in gold?

Which specialists are most in demand on the market?

The financial industry is constantly facing the growing needs of staff resulting from new market regulations. The most demanding recruitments are primarily those related to roles specific to the financial sector, i.e. actuaries, risk specialists, modelers or risk model validators. Both banks and insurance companies devote more and more financial and human resources to managing the risk area in the organization. It results directly from their regulatory environment, as well as from the dynamically changing economic environment in the country and in the world.

Actuary - they work wherever risk assessment specialists are needed, mainly in financial institutions. In practice, the actuary should have knowledge of, inter alia, in the field of probability and statistics, financial mathematics, risk management, demography, financial modeling, insurance accounting and legal regulations.

Risk modeling specialist - a person who is a member of the team responsible for implementing the risk management strategy. The risk modeler must have, inter alia, high analytical skills; skills and competences in building and developing statistical models.

Data scientist - a person dealing with, among others collecting, processing, analyzing and visualizing data using machine learning and learning algorithms. Data Scientist is, in a very simplified manner, a combination of the Data Engineer and Data Analyst professions. A Data Science specialist must have skills and competencies in many different areas. He should be able to program, know big data technologies and data analysis, and additionally have communication skills and understand business.

Data analyst - Data analysts are responsible for understanding information and identifying ways to turn it into practical business strategies. As a result, they help companies use the true potential of data to positively influence the development of a given business. In addition, they analyze the market and competition to identify key trends in a given industry.

Professions of the future in banking and insurance

A position that will certainly gain even more value is data scientist. In theory, this is a person who focuses on collecting, processing, analyzing and visualizing data using advanced tools such as machine learning. In practice, in this position, it is important to have numerous competences in many different specialties:

- mathematical and analytical skills,

- programming skills, e.g. in R, SQL, Python, SAS

- presentation of analyzed data and drawing specific business conclusions.

On the one hand, data science has recently become a typical buzzword, on the other hand, companies are becoming more and more aware that collecting, analyzing and processing data undoubtedly constitutes a competitive advantage. As a result, no organization wants to lose in the race for data, and thus - for the right people capable of processing it.

In the fight for talented data scientists, unfortunately, insurance companies often lose to much more technologically advanced banks or fin-techs. Currently, there are nearly 700 active job offers in the data science area on the web. Often these are numerous vacancies, which makes it possible to estimate that the Polish labor market currently needs over 1,000 data analysts. Considering that in many cases the experience gained in a particular industry does not matter, the competition for the financial sector is huge.

An equally important job of the future in banking and insurance is also a data analyst. In a world dominated by information, the work of data analysts is essential and, in fact, they have already become one of the most sought-after specialists in the labor market. The data itself, which is the source of infinite information, is already a key technology they are involved in the transformation processes of enterprises. So, anyone who chooses to focus their career on data analytics is likely to be successful in the digital age. Companies increasingly place particular emphasis on the knowledge of programming languages used in data analysis. Commonly required skills for data analyst job advertisements are:

- knowledge of Python and / or SQL

- willingness to experiment with various analytical methods

- the ability to draw conclusions

- knowledge of English, both on the utility and technical level (welcome).

About the report

The Antal 2022 Salary Report was prepared on the basis of the payroll analysis carried out by 8657 specialists and managers participating in Antal's recruitment processes in the second half of 2021 and the first half of 2022.

These data were verified and extended with information from recruitment processes carried out by Antal consultants in 2020, as well as telephone interviews with employers and candidates.

Download report: https://antal.pl/wiedza/raport/raport-placowy-antal-2022